What began as a White House trade announcement quickly snowballed into a continental disruption that few saw coming.

When Donald Trump moved to raise steel and aluminum tariffs from 25% to 50%, the message was meant to project strength. Instead, it triggered a chain reaction across North America—one that exposed how deeply U.S. manufacturing depends on Canadian steel, and how prepared Canada was to say no.

Canadian officials didn’t mince words. The tariffs were labeled “unjustified,” “illegal,” and damaging not just to Canada, but to American workers and industry. Markets listened faster than diplomats. Supply chains that had taken decades to knit together began to fray in days.

By August 1, Canadian steel exports outside USMCA protections faced an effective 35% additional tariff, turning political posturing into an immediate industrial confrontation. The stated justification—linked publicly to fentanyl enforcement—was dismissed by Ottawa. But investors weren’t waiting for explanations. Capital shifted. Buyers rushed orders out of fear. Manufacturers braced for shortages.

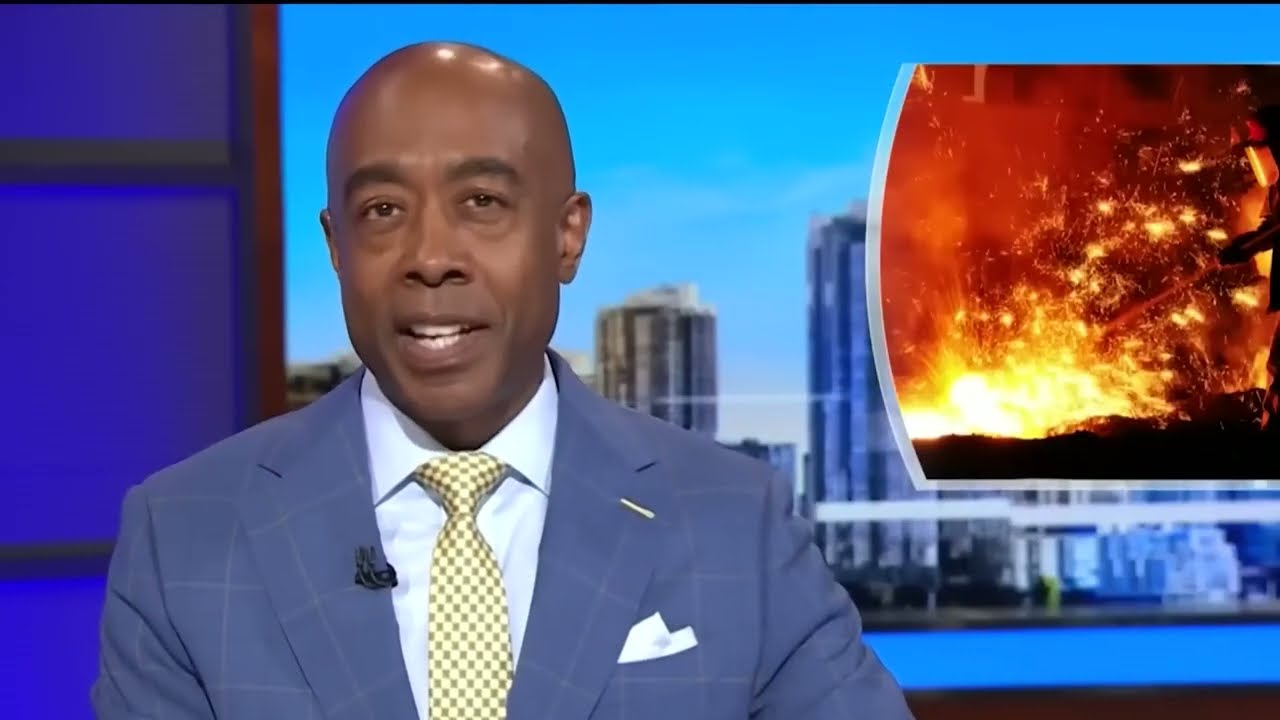

And then prices exploded.

Hot-rolled coil steel surged to $900 per ton, jumping $150 in just two weeks. For automakers, the math broke instantly. Ford, GM, and Stellantis rely heavily on Canadian steel, with the F-150 alone using roughly a ton per vehicle. Canadian shipments—up to 12 million tons annually—had long been the invisible backbone of U.S. assembly lines.

When tariffs hit, purchase orders were suddenly canceled. Rail shipments slowed. Inventory systems flashed red. At Ford’s River Rouge complex, stamping operations were halted as supply thinned. Wall Street took notice. The S&P 500 dipped nearly 1% amid fears a metal-driven slowdown was brewing.

The pain wasn’t abstract—it was personal.

In Windsor, where manufacturing is generational, anxiety seeped into lunchrooms and living rooms alike. In Michigan, unemployment climbed to 5.4%, the highest in the nation at the time, as layoffs and hiring freezes followed steel shortages. Detroit, once confident in cross-border reliability, faced paralysis. Meanwhile, Hamilton’s furnaces kept running—quietly signaling a shift in leverage.

Canada didn’t retaliate with theatrics. It responded with strategy.

Within 48 hours, Prime Minister Mark Carney unveiled a $1 billion steel modernization plan, accelerating the shift from coal-fired furnaces to electric arc and hydrogen-based systems powered by hydroelectric and nuclear energy. The move aligned with climate goals—but more importantly, it positioned Canadian steel to dominate markets with strict emissions standards.

Ottawa followed with quotas on steel imports from non–free trade countries and a 25% duty on Chinese steel, protecting domestic producers from dumping. Federal procurement rules were tightened to prioritize Canadian-made steel, with provinces echoing the move for infrastructure, transit, housing, and pipelines.

Jobs stayed home. Supply chains shortened. Canada’s bargaining power grew.

South of the border, the warnings mounted. Ford’s CEO told Congress the tariffs could cost the company $2.5 billion annually, adding nearly $900 to the cost of each F-Series truck. Dealership sticker prices jumped $1,500 to $2,000. Vehicles sourced from Mexico surged as much as 25%.

The shock spread beyond autos. Texas energy firms reported shortages of steel pipe as Canadian producers focused on domestic and overseas contracts. Enbridge repurposed older inventory to stay operational. Smaller contractors struggled to find supply at any price.

Washington pressed Ottawa to ease restrictions, calling them a blockade. Canada declined—offering only targeted quotas that preserved its advantage while avoiding outright retaliation. Instead, Ottawa diversified.

By mid-2025, Canadian steel exports to the U.S. fell from 75% to 68%, while shipments to the EU, Japan, and India surged—markets aligned with Canada’s low-carbon strategy. Multi-year contracts locked in revenue through 2027. Dependence on U.S. demand shrank.

The human cost remained heavy. In Ontario, suppliers faced erratic orders. In Windsor, comparisons to the 2008 collapse resurfaced. In the U.S., furloughs hit plants tied to Canadian steel, and families postponed major life decisions as uncertainty deepened.

And beneath it all, a sobering lesson emerged.

Tariffs didn’t create leverage where preparation already existed. They exposed who was ready—and who wasn’t. Canada entered the crisis diversified, modernizing, and willing to redirect supply. The U.S. entered assuming the old system would bend without breaking.

It didn’t.

What was framed as a show of strength ended as a warning shot—for Detroit, for Washington, and for any industry that assumes supply chains are permanent. In this standoff, Canada didn’t shout. It adjusted. And overnight, the balance shifted.