What began as a routine shipping disruption has rapidly escalated into one of the most unsettling moments the American agricultural sector has faced in decades. Multiple U.S. wheat shipments, bound for overseas markets, have reportedly been rejected at international ports, triggering a sudden and chaotic redirection of global demand—away from the United States and straight into Canada’s hands.

Within hours of the first reports surfacing, importers from Asia, the Middle East, and Africa began shifting contracts north. Canadian exporters, initially caught off guard, found themselves at the center of a historic buying spree. Ottawa, long a major but secondary player in global wheat trade, was suddenly thrust into the spotlight as the preferred supplier for buyers seeking stability in an uncertain market.

A Shock That Spread Fast

Industry insiders describe the rejection of U.S. wheat shipments as a tipping point rather than an isolated incident. While details vary by destination, buyers cited concerns over consistency, reliability, and delivery assurances—factors that have grown increasingly important amid global supply chain stress.

What stunned analysts was not just the rejection itself, but the speed of the reaction. Global commodity markets move quickly, but this shift was described as almost instantaneous. Contracts that once defaulted to American suppliers were rerouted to Canadian producers within hours, bypassing U.S. exporters entirely.

“Buyers didn’t wait,” said one international grain trader. “They moved.”

Panic Across the American Farm Belt

As the news rippled through the United States, the impact was felt first in the heartland. Warehouses began filling with unsold wheat. Futures prices dipped sharply. Farmers who had already committed to planting, harvesting, and storage suddenly faced a market with fewer doors open.

Across several wheat-producing states, agricultural cooperatives reported rising concern among farming families. Many operate on thin margins, relying on predictable export flows to remain solvent. With shipments stalled and prices slipping, the fear of widespread financial distress has grown palpable.

“This isn’t just about one season,” said a Midwest farm association representative. “It’s about confidence in American agriculture as a whole.”

A Furious Reaction at the Top

According to sources familiar with internal discussions, the emergency briefing quickly made its way to Mar-a-Lago. There, Donald Trump was reportedly livid.

Witnesses described Trump as erupting in anger upon hearing that global buyers were favoring Canadian wheat over American exports. “Why the hell are they buying from Canada?” he reportedly shouted. “American wheat should dominate the world!”

The reaction underscored a deeper frustration: the idea that U.S. agricultural dominance—long considered unquestionable—was being openly challenged in real time.

Importers Send a Blunt Message

While political outrage simmered at home, international buyers offered a far calmer, more calculated explanation for their decisions.

“We want stability, quality, and reliability,” one importer said bluntly. “Right now, that’s Canada.”

The message was echoed across multiple regions. Buyers emphasized that their shift was not ideological or political, but practical. In an era of volatile markets and tight margins, predictability matters more than tradition.

“It’s not about who you were,” said a Middle Eastern procurement official. “It’s about who can deliver.”

Canada Caught Off Guard — and Cashing In

North of the border, the reaction was one of surprise mixed with urgency. Canadian grain handlers and shipping companies were suddenly inundated with new contracts. Stockpiles had to be expanded. Additional vessels were chartered. Port operations were pushed into overdrive to meet demand.

Government officials and industry leaders described the surge as one of the most dramatic shifts in recent memory. Some called it an opportunity; others warned of strain if the pace continued.

“We weren’t prepared for this volume,” admitted one Canadian exporter. “But we’re moving fast.”

The sudden influx has already triggered some of the largest wheat shipping deals Canada has seen in years, reshaping trade flows that had remained relatively stable for decades.

“Not a Dip — a Collapse”

Behind closed doors in Washington, the tone has reportedly grown more somber. At an emergency economic meeting, one adviser summarized the situation in a stark assessment: “This isn’t a market dip — this is a full-blown wheat collapse.”

That statement, according to those present, silenced the room.

Analysts warn that once buyers shift supply chains, reversing the flow is far from easy. Contracts, logistics, and trust all play a role. If Canada continues to deliver consistently while U.S. shipments remain uncertain, the damage could extend well beyond a single season.

A Global Crown at Risk

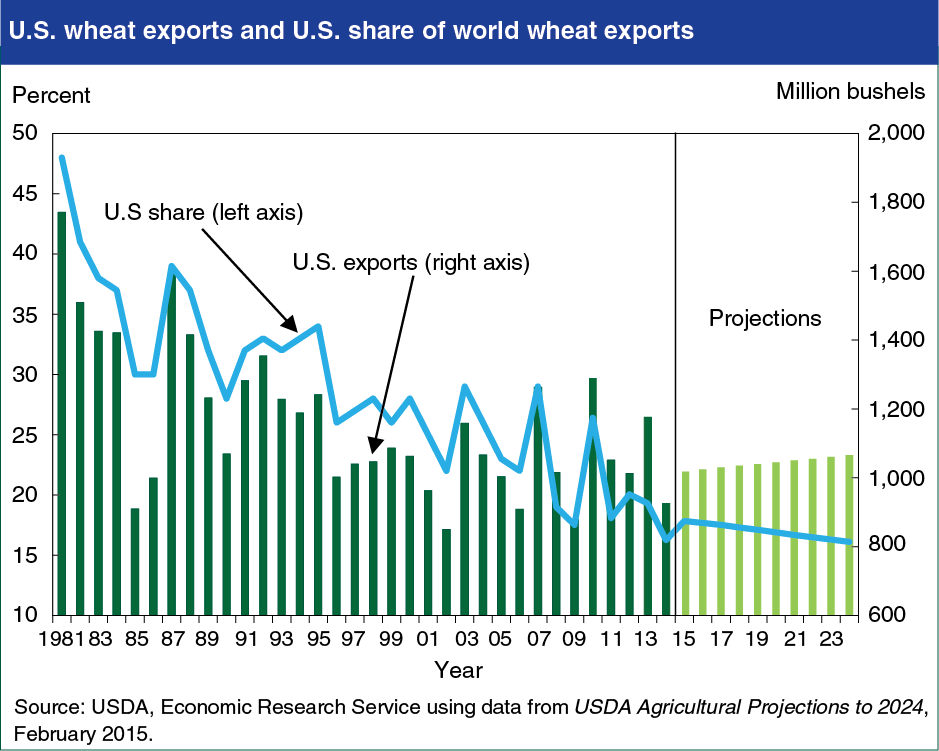

For decades, the United States has worn the crown as one of the world’s most reliable agricultural exporters. Wheat, in particular, has been a symbol of that dominance. But experts now suggest the crown may be slipping.

One agricultural economist ran simulations based on current trade redirections and reached a sobering conclusion: “For the first time in decades, the global wheat crown may be shifting north.”

Such a shift would have implications far beyond farming. Export revenues, rural employment, trade balances, and geopolitical influence are all tied to agricultural power.

The Bigger Question

As markets adjust and political rhetoric intensifies, a deeper question looms: is this crisis the result of a temporary disruption—or a warning sign of structural decline?

Supporters of U.S. agriculture argue that the country still has unmatched capacity, innovation, and scale. Critics counter that reliability, not volume, now defines leadership in global trade.

For American farmers staring at overflowing warehouses, the answer feels painfully immediate. For Canada, the opportunity feels historic. And for global buyers, the decision has already been made—at least for now.

The wheat is moving. Just not where it used to.