A political storm is brewing around Mark Carney—and it’s getting uglier by the day.

After months of Canada trying to stabilize its relationship with China while managing escalating friction with the United States, Donald Trump just signaled something that could leave Ottawa boxed in from both sides: a direct U.S.–China push on oil, gas, and agriculture that threatens to sideline Canada at the worst possible moment.

It started with Trump announcing a “long and thorough” phone call with Chinese President Xi, teasing an April trip to China and listing a grab-bag of big-ticket issues: trade, military concerns, Taiwan, the Russia–Ukraine war, and—most critically for Canada—China’s purchase of oil and gas and a potential surge in agricultural buys.

Trump highlighted China “lifting the soybean count” to 20 million tons for the current season and referenced larger commitments ahead, plus other industrial items like airplane engines.

That’s not just diplomatic chatter. That’s a signal to markets and supply chains: Washington and Beijing are talking business—big business—without Canada at the center of the conversation.

And that’s where Carney’s problem gets sharper. Canada has been trying to manage trade turbulence by keeping channels open with China while insisting it’s not chasing a sweeping free-trade deal.

But Trump’s tone suggests he sees Canada’s China outreach as a potential threat—or worse, as a move that invites retaliation. If the U.S. and China can cut their own deals on energy and agriculture, Canada’s bargaining power gets thinner, fast.

The tension is being fueled by a parallel storyline: security fears tied to China that are now landing on both sides of the border.

In the U.S., the video points to a reported investigation involving a “biological laboratory” case with alleged ties to a Chinese citizen facing federal charges in California related to misbranded medical devices—one of several developments the commentator frames as a warning sign.

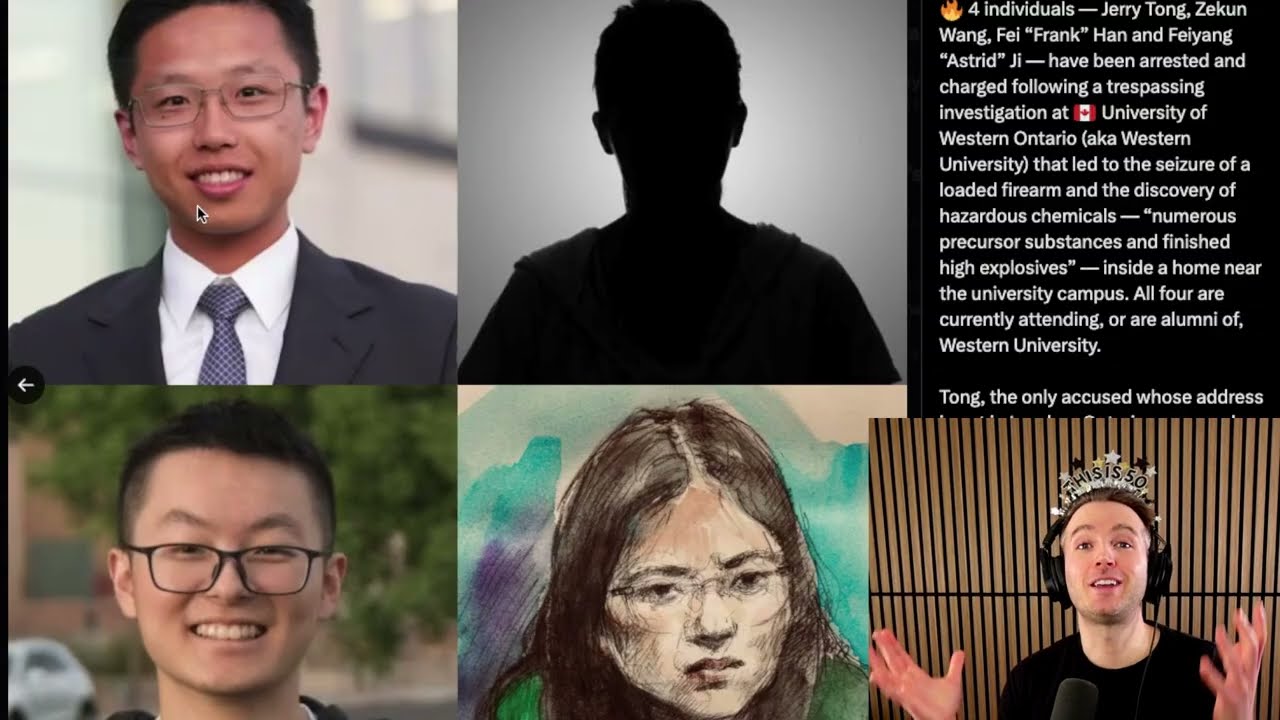

In Canada, the commentary references a case at Western University where four individuals were arrested following a trespassing investigation, and police reportedly seized a loaded firearm and materials described as hazardous chemicals and explosive precursors.

Whether or not these incidents end up connected in any meaningful way, the political impact is obvious: they harden public suspicion and make any Canada–China trade thaw far harder to defend.

Every new headline raises the risk that Ottawa’s “trade-first” logic gets drowned out by security-first panic.

Then comes the part that really stings: the critical minerals race.

The commentator claims the U.S. is accelerating a critical minerals strategy with partners like the EU, Japan, and Mexico—while Canada is notably absent from the “branding” and formal action plans being discussed.

The implication is brutal: while Canada has mineral wealth, America is organizing the next phase of the supply chain without treating Canada like a default teammate.

If that’s true, it’s a warning flare for Ottawa. Critical minerals are supposed to be Canada’s power play—especially as the U.S. tries to build its own refining capacity and reduce reliance on China.

But if Canada isn’t locked into those frameworks early, it risks being treated as optional rather than essential.

And there’s another twist: Venezuela.

The video points to U.S. officials discussing licenses that could allow American firms to pump and process Venezuelan crude—a type of heavy oil similar to what many U.S. refineries import from Canada.

While Venezuela currently produces under a million barrels per day (far below its historical peak), the message is clear: the U.S. is exploring alternatives, and if capital flows south to Venezuela while projects in Canada stall, Canada’s energy leverage could weaken over time—even if replacement isn’t immediate.

The rest of the video pivots to a harsh domestic critique: that regulatory uncertainty and investment friction are chasing away major projects in Canada, citing examples like delayed pipelines and a paused Quebec smelter investment tied to emissions rules.

The underlying accusation is simple: Canada can’t afford to posture geopolitically if it can’t attract and execute large-scale industrial investment at home.

Put it all together and Carney’s squeeze becomes obvious. Trump is courting China directly on the exact sectors where Canada typically holds leverage—energy and agriculture—while security fears and supply-chain realignment make Canada’s China strategy politically toxic.

Even if Ottawa insists it’s simply resolving trade disputes, the optics are dangerous.

In a world where superpowers negotiate on the phone and markets react in minutes, Canada’s biggest risk isn’t losing an argument—it’s being treated like a bystander.