The shock didn’t come from a tariff announcement or a press conference—it came from the silence at the border. In towns that live off weekend plates from Quebec and Ontario, parking lots that used to fill by noon are suddenly half-empty, and shop owners are watching the drop hit the register in real time.

This week, U.S. lawmakers finally put a number on what border communities have been whispering for months: Canadian visits are falling sharply, and it’s no longer just a “vibe.” Democrats on the Joint Economic Committee released a report warning that President Donald Trump’s escalating trade posture toward Canada is carrying a price tag—especially for states that depend on quick Canadian trips for gas, groceries, shopping, and tourism. In Maine, U.S. Customs and Border Protection data cited in coverage shows border crossings in 2025 are down nearly 20% compared with the same period last year.

That kind of decline doesn’t just dent souvenir sales. It starves the small businesses built around predictable cross-border rhythm—cafés that rely on weekend surges, family motels that survive summer traffic, and seasonal operators who can’t “make it up later” once the rush is gone. Even ferry routes are feeling it. Reporting on the Yarmouth, Nova Scotia–Bar Harbor, Maine “CAT” ferry noted an almost 20% drop in summer business, and local officials tied at least part of the slide to the temperature of the political moment.

Then comes the twist Washington didn’t seem to anticipate: Canada isn’t just complaining—it’s adapting. And those adaptations don’t end when the headlines do.

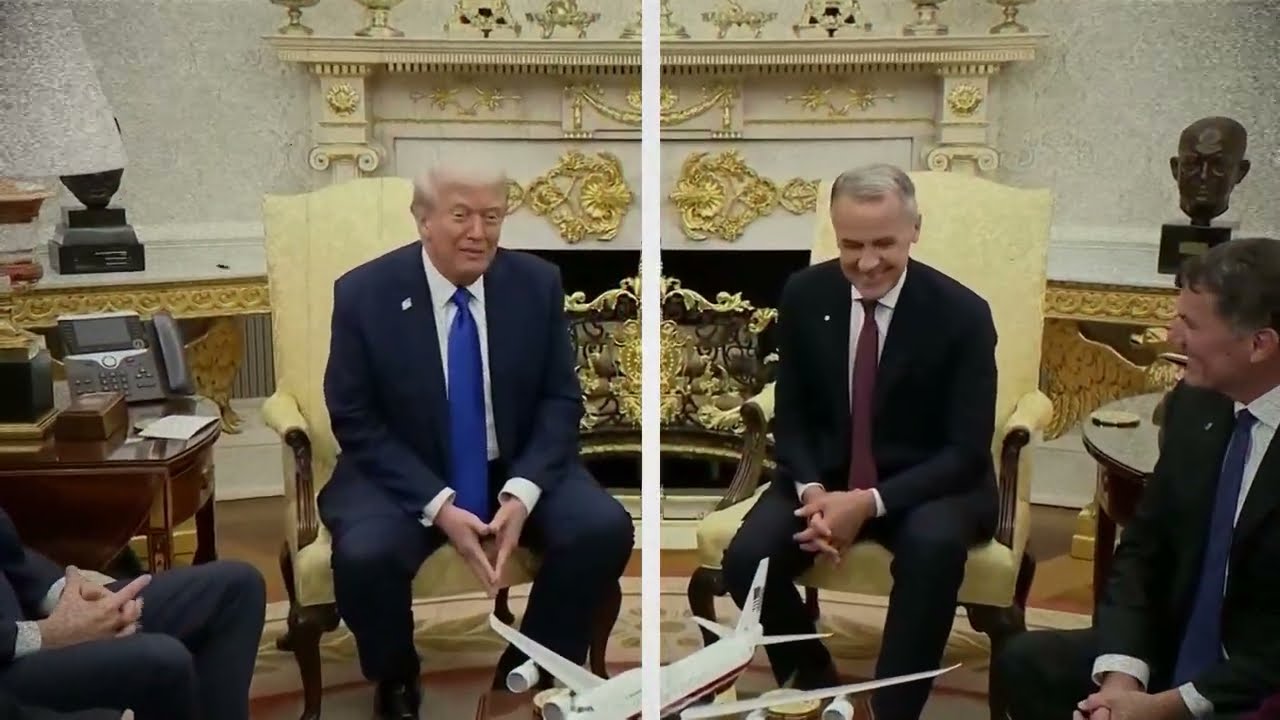

Prime Minister Mark Carney has framed Canada’s response as something colder than retaliation: restructuring. That means reducing assumptions about the U.S. as the default economic partner and building “home advantage” into policy. One of the clearest signals is Canada’s new “Buy Canadian” approach to federal procurement—turning government spending into a lever that favors Canadian suppliers and Canadian-made inputs in strategic contracts.

Under the policy, Canada is prioritizing Canadian suppliers and Canadian content in major procurements, starting with high-value contracts (with expansion planned to a wider set of contracts by spring 2026). It also requires large federal construction and defense projects above a threshold to use Canadian-produced steel, aluminum, and wood where domestic supply is available—materials must be manufactured or processed in Canada, not merely resold.

That’s the part U.S. lawmakers are now sounding alarms about: once these patterns change, they don’t always snap back. Fewer Canadian trips south today can become fewer habits tomorrow. Less reliance on U.S. suppliers can become permanent supply-chain rewiring. And once a government codifies “we buy domestic by default,” American businesses don’t just lose a news cycle—they lose a lane.

Meanwhile, the scale of the Canadian travel relationship is big enough that even modest percentage drops hurt in concentrated places. Canadian travelers collectively spend tens of billions in the U.S.; one widely cited figure for 2024 spending is $20.5 billion. The damage doesn’t hit Manhattan first—it hits the border towns that can’t absorb a sudden 20% hole.

That’s why this moment feels different: Congress isn’t warning Trump because Canada is “mad.” Congress is warning because the math is showing up in real communities—and Canada’s response is moving from protest to blueprint. If this becomes the new normal, the next question is brutal and unavoidable: how much of this economic relationship can Washington “win” before it permanently breaks something it can’t rebuild?