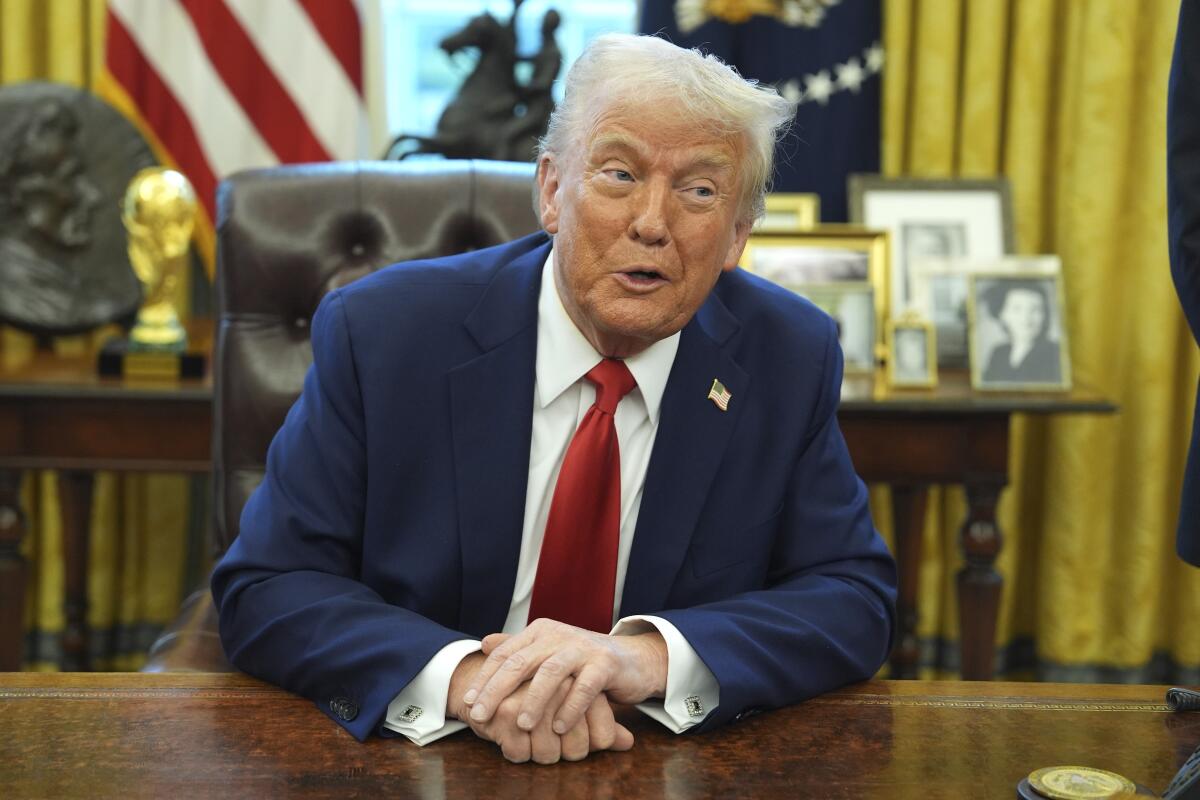

A seismic shift in North American trade policy has sent shockwaves through the lumber industry, crippling a U.S. titan and threatening the foundation of the American housing market. The immediate fallout from President Trump’s aggressive 25% tariff on Canadian softwood lumber has materialized with devastating speed, exposing deep fractures in cross-border relations and economic planning.

Wire Huser, a leading U.S. lumber company, has become the starkest casualty of the policy. The firm’s second-quarter profits for 2025 were brutally halved, plummeting from $173 million to a mere $87 million compared to the same period last year. This precipitous drop stunned investors and signaled profound market distress as new tariff measures loom.

The company’s leadership, while publicly endorsing the tariffs as necessary to combat subsidized Canadian competition, delivered a grim forecast to shareholders. They project a further $60 million decline in adjusted earnings for the third quarter, citing weakening demand, excess supply, and soaring costs.

This financial turmoil stems from a deliberate escalation by the U.S. government. In February 2025, the 25% duty was imposed, layered atop existing anti-dumping and countervailing duties. By late July, the Commerce Department finalized an additional 20.56% anti-dumping duty on 2023-period lumber, pushing combined tariff burdens toward a crushing 40%.

Commerce Secretary Howard Lutnik left no ambiguity, declaring the August 1st deadline for enforcement would allow no exemptions or delays. This hardline stance has transformed a long-simmering trade dispute into a fundamental collision between political ambition and economic reality.

The repercussions are radiating far beyond corporate balance sheets directly into the American homebuilding sector. U.S. single-family home sales in May recorded their sharpest decline in nearly three years, hammered by the double blow of rising interest rates and spiking lumber import costs.

Builders have grown deeply cautious, with many putting projects on hold as potential buyers retreat from the market. Analysts warn the tariffs could inflate the cost of a new home by as much as $14,000 by 2027, a prospect that threatens to freeze an already cooling housing market.

Across the border, Canada is executing a calculated and multifaceted response that extends far beyond diplomatic protests. Trade Minister Dominic LeBlanc pointedly highlighted that Canadian pension funds hold roughly $1 trillion in U.S. investments, a figure growing by $100 billion annually—a potent, if subtle, source of leverage.

In a significant strategic pivot, Ottawa is now actively considering imposing export quotas on softwood lumber, a measure long demanded by Washington but previously rejected. This shift gained traction during recent visits by bipartisan U.S. senators seeking a managed trade framework.

Simultaneously, Canadian exporters are rapidly diversifying their markets. The U.S. share of Canadian lumber exports has already fallen from 78% to 68% within a year, with shipments increasingly redirected to Europe and Asia, reducing dependency on American markets.

The Trump administration’s stated goal is to revive the domestic lumber industry, but its primary plan faces severe practical limitations. A proposal to increase logging quotas on federal lands by 25% would, by expert assessment, boost total national timber supply by less than 1%.

This marginal gain is described by industry observers as attempting to refuel a V8 engine with a coffee straw. Regions like Scammania County, once thriving with sawmills, continue to grapple with critical shortages of raw timber, underscoring the vast gap between policy and production capacity.

Some adaptation is underway. U.S. mills are investing in automation, while Canadian firms are establishing operations in the southern U.S. to be closer to pine forests and circumvent tariffs. However, legal challenges and environmental lawsuits pose persistent risks to any expansion of logging activity.

Caught in the crossfire are companies like Wire Huser, which is attempting to fortify itself through timberland acquisitions and a $100 million share buyback program. Yet these defensive measures may prove insufficient against a backdrop of collapsing housing demand and relentless margin pressure.

The softwood lumber dispute has entered a decisive and dangerous phase. Washington is betting that escalating pressure will force Canadian concessions and resurrect U.S. mills. Ottawa is responding with financial leverage, market diversification, and strategic negotiation.

The ultimate cost, however, is being borne by American consumers and builders, who face higher prices, delayed projects, and cascading instability throughout the construction supply chain. This conflict is no longer a routine trade spat; it is a high-stakes struggle over who will control the economic and physical landscape of North America.